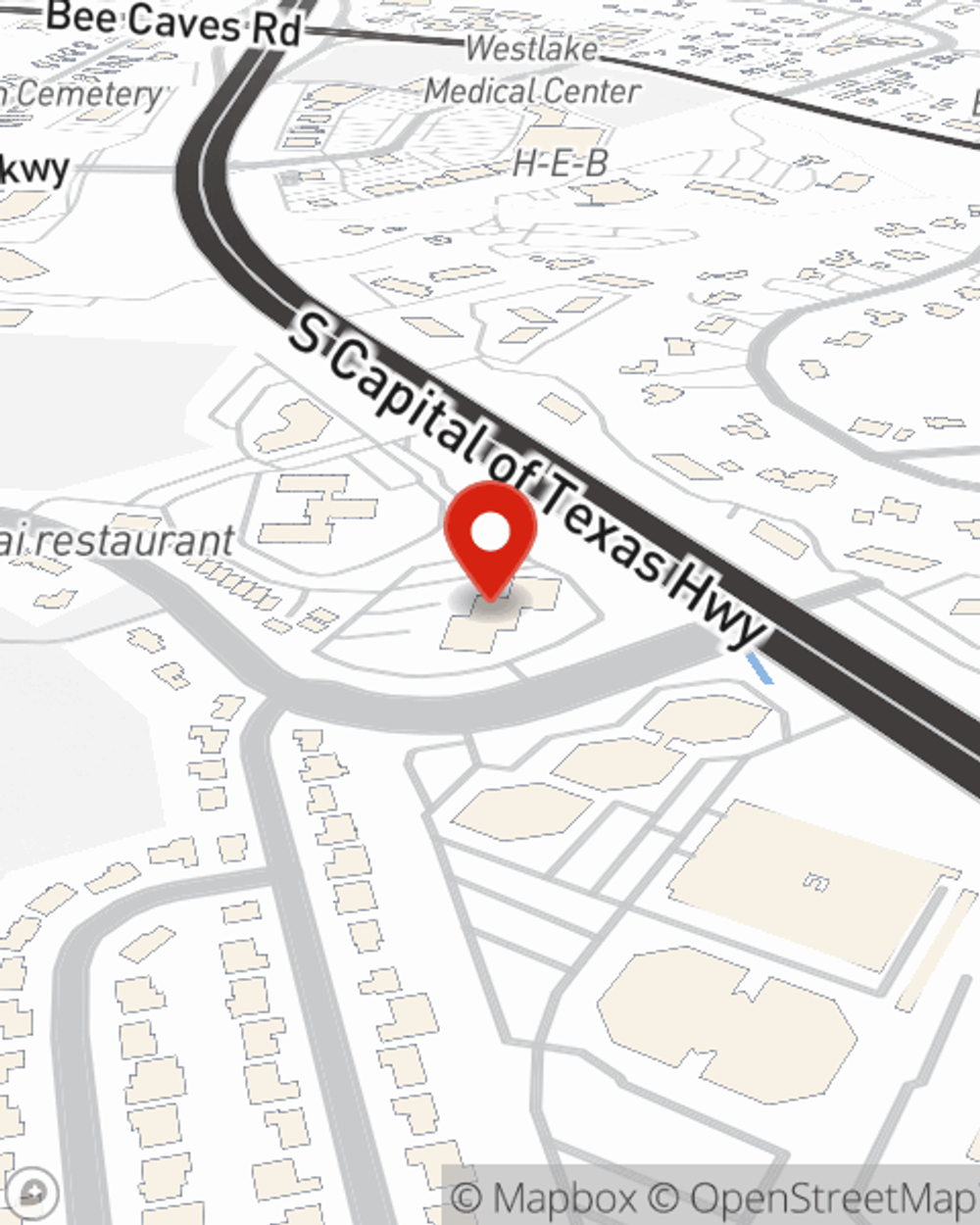

Insurance in and around Austin

Multiple ways to help keep more of your hard-earned dollars

Protect what matters most

Would you like to create a personalized quote?

Tried And True Insurance Customizable To Fit You

You’ve worked hard to get to where you are. But life can often throw the unexpected at you. Let State Farm® insurance help protect you, your loved ones and the life you’ve built. Find a coverage plan that protects what’s important to you – family, things and your bottom line. From safe driving rewards, bundling options and discounts, you can create a solution that’s right for you. Contact M. Lynn Osler today for a Personalized Price Plan.

Multiple ways to help keep more of your hard-earned dollars

Protect what matters most

Protect Your Family, Vehicles, Home, And Future

If you're looking for outstanding coverage options, great claims service, and competitive prices, look no further. State Farm is the largest insurer of automobiles and homes in the U.S. for a reason.

Simple Insights®

Volunteering at a school

Volunteering at a school

Volunteers in schools are an integral part of helping students and teachers. There are countless ways for you to give back, starting today.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.

M. Lynn Osler

State Farm® Insurance AgentSimple Insights®

Volunteering at a school

Volunteering at a school

Volunteers in schools are an integral part of helping students and teachers. There are countless ways for you to give back, starting today.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.